Table of Contents

Step 1. Operator Portal Step 2. Stripe PortalStep 3. Complete VerificationStep 4. Creating Multiple Stripe Accounts for Multiple VenuesStep 1. Operator Portal

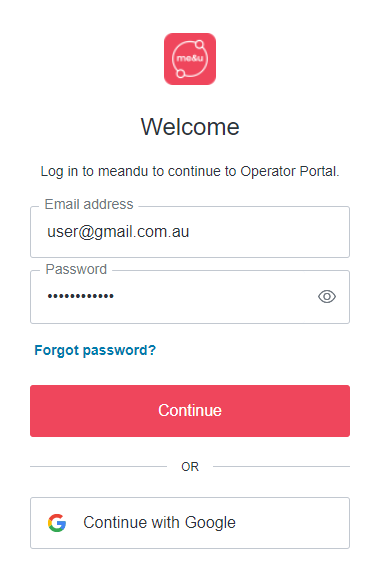

1. Log into me&u Operator Portal

- Go to manage.meandu.com

- Log in with your email address and password provided by me&u staff

- If you can't remember your password click the reset password option under the login

Delete

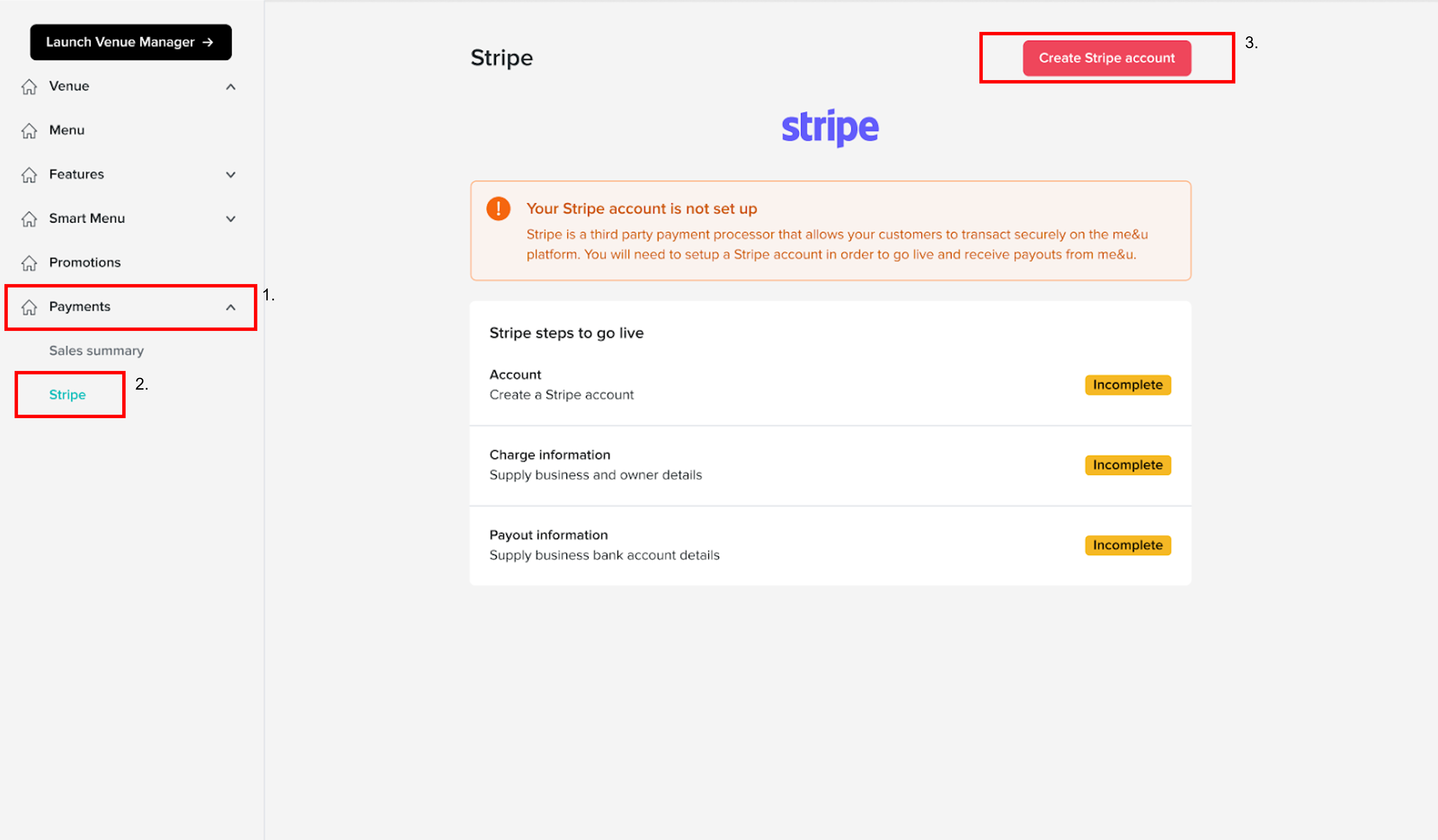

2. Create Stripe Account

- Click on 'Payments'

- Select 'Stripe'

- Select 'Create Stripe Account' at the top right hand side of the screen

- You will be redirected to the Stripe portal to create your account

Step 2. Stripe Portal

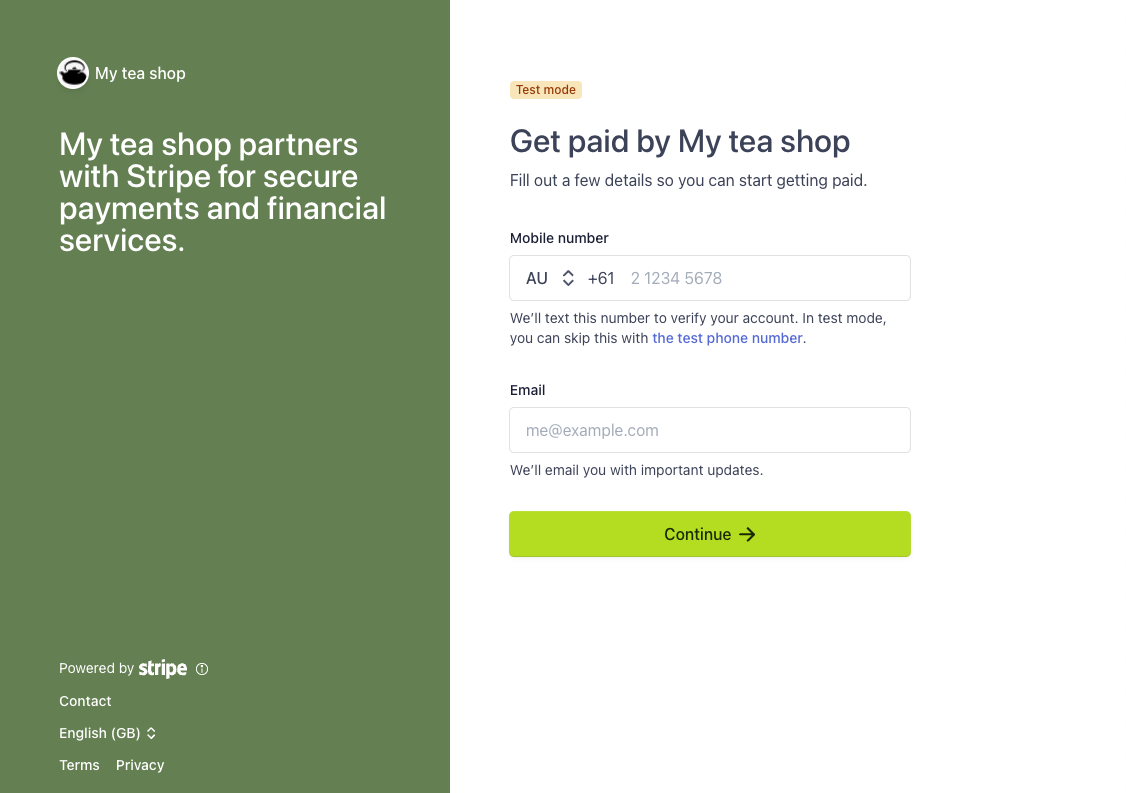

1. Contact Details

Note: Throughout the Stripe onboarding process you will be asked to supply the personal information (name, DOB, job title, home address, % of ownership of business) of the owners of your company.

It therefore is recommended that either a business owner or legal business representative completes the Stripe application process.

Additionally, have the following documents handy:

- Business details including ABN, ACN, address, phone number, industry, website, bank account, etc.

- Your personal details and that of your colleagues, including name, home address, date of birth, job title, phone number

- % of ownership for each owner of your business

- Scans of identification documents

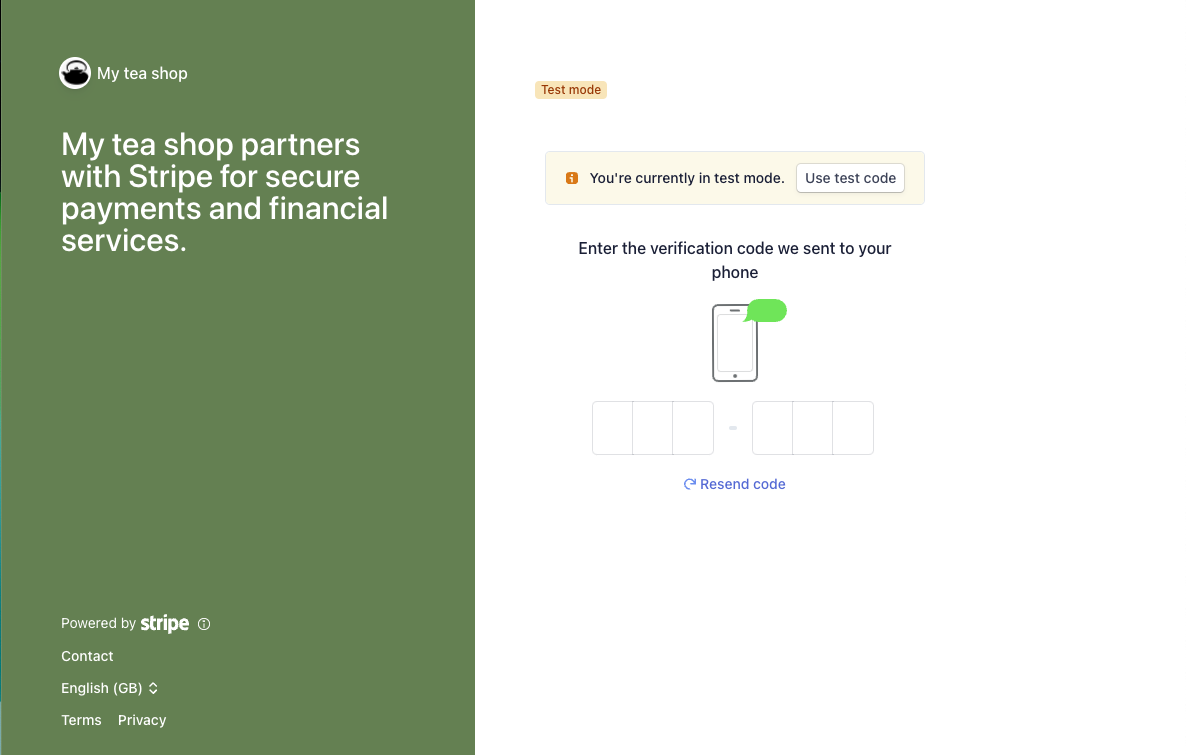

2. Verification of Contact Number

Note: After onboarding, every time you access the Stripe dashboard, you will need to verify in the same way.

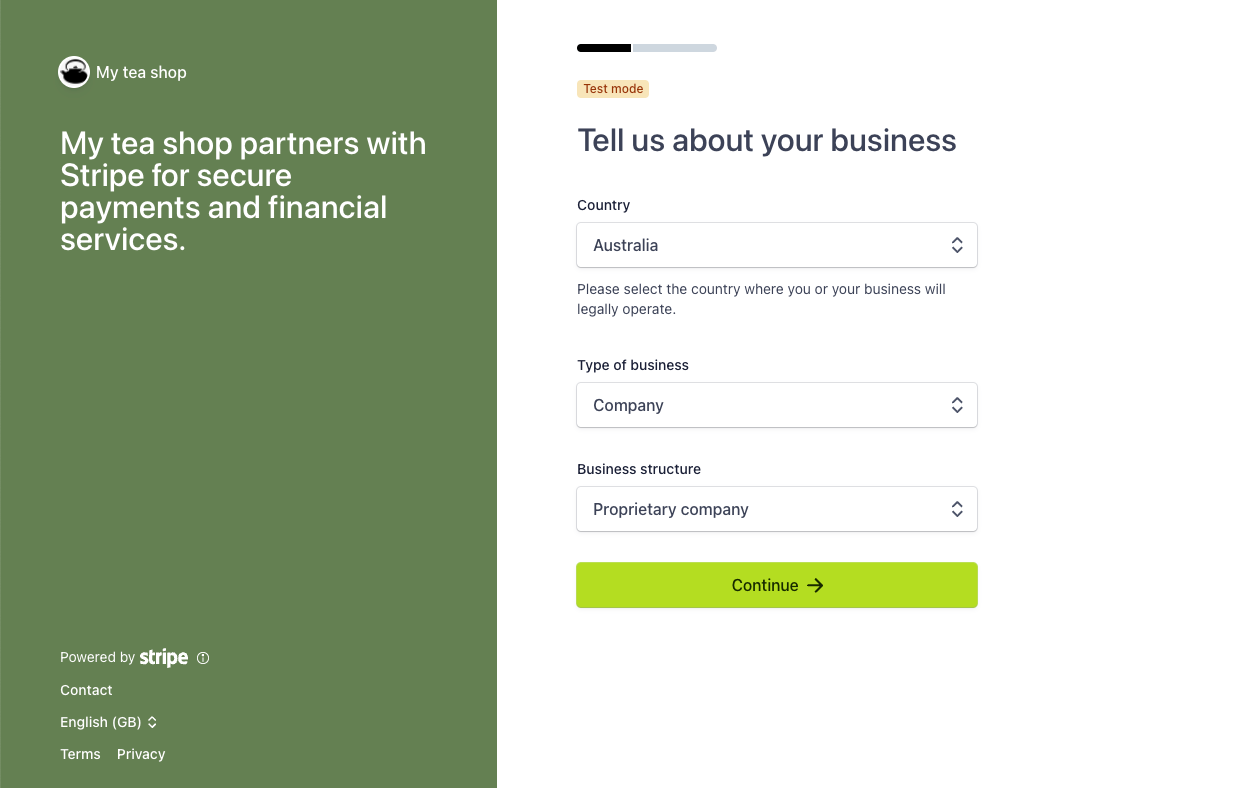

Delete3. Business Details

The requirements to complete onboarding will change depending on the country and type of business.

Types of businesses are:

- Public or proprietary company

- Partnership

- Trust

- Individual / Sole Trader (with or without ABN)

- Not-for-profit (incorporated association, unincorporated association, cooperative, other)

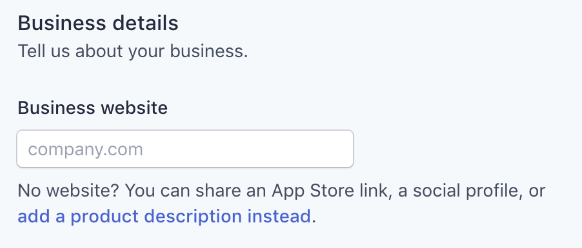

The Business website field will display on your customer's bank statements. Once added, it cannot be amended.

The above is the field where you have the options to either:

- Use a website address as your statement descriptor

Or

- Click the link "add a product description instead." This will allow you to manually type in whatever you want to reflect on your customer's bank statements

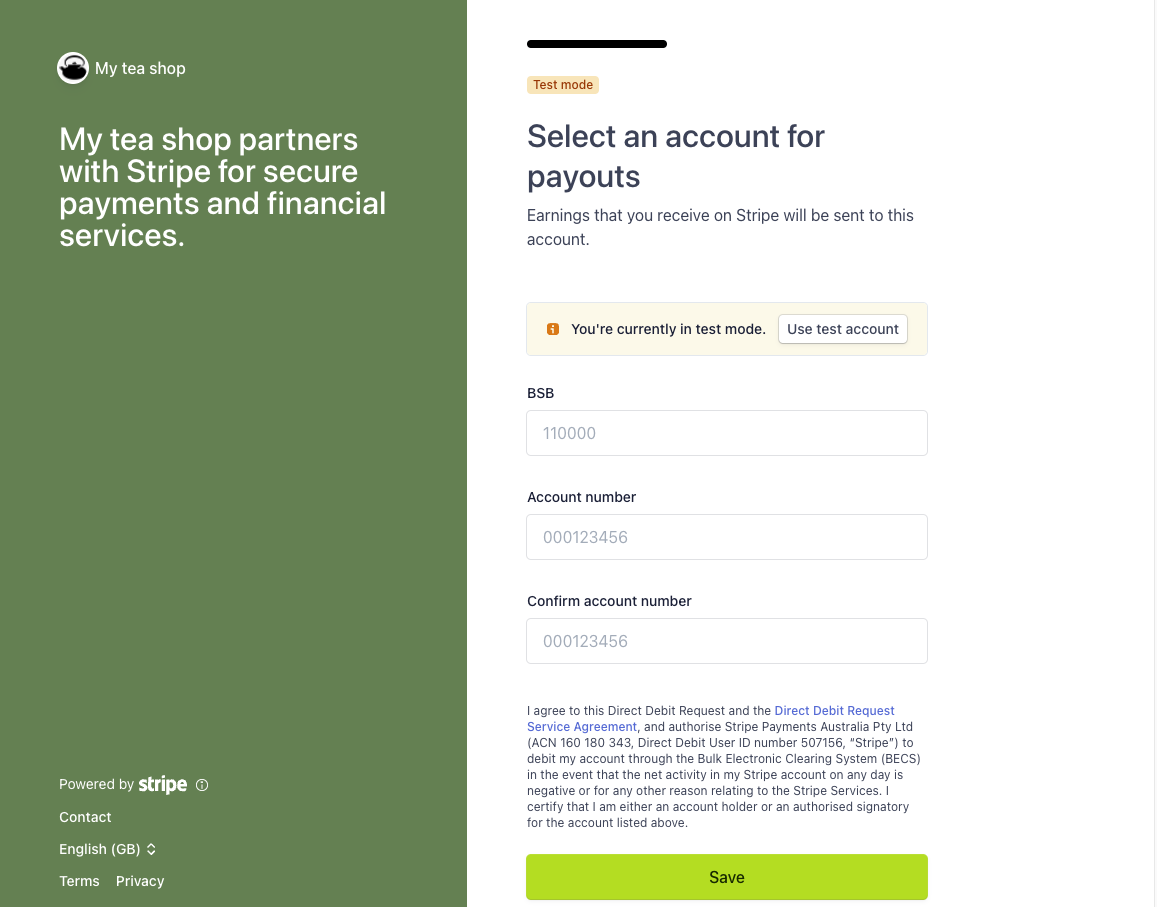

4. Bank Account Details

After completing your business specific details enter the bank details you would like Stripe to send your payouts to.

Delete5. Summary

The summary will flag any sections where required information is missing. You will not be able to proceed until all required information has been provided.

Based on your business structure - when updating the Account representative and/or beneficiaries of your business a KYC check will be triggered.

Updating directors will not trigger KYC.

If Stripe cannot verify the person based on the information provided, you will need to provide proof of ID.

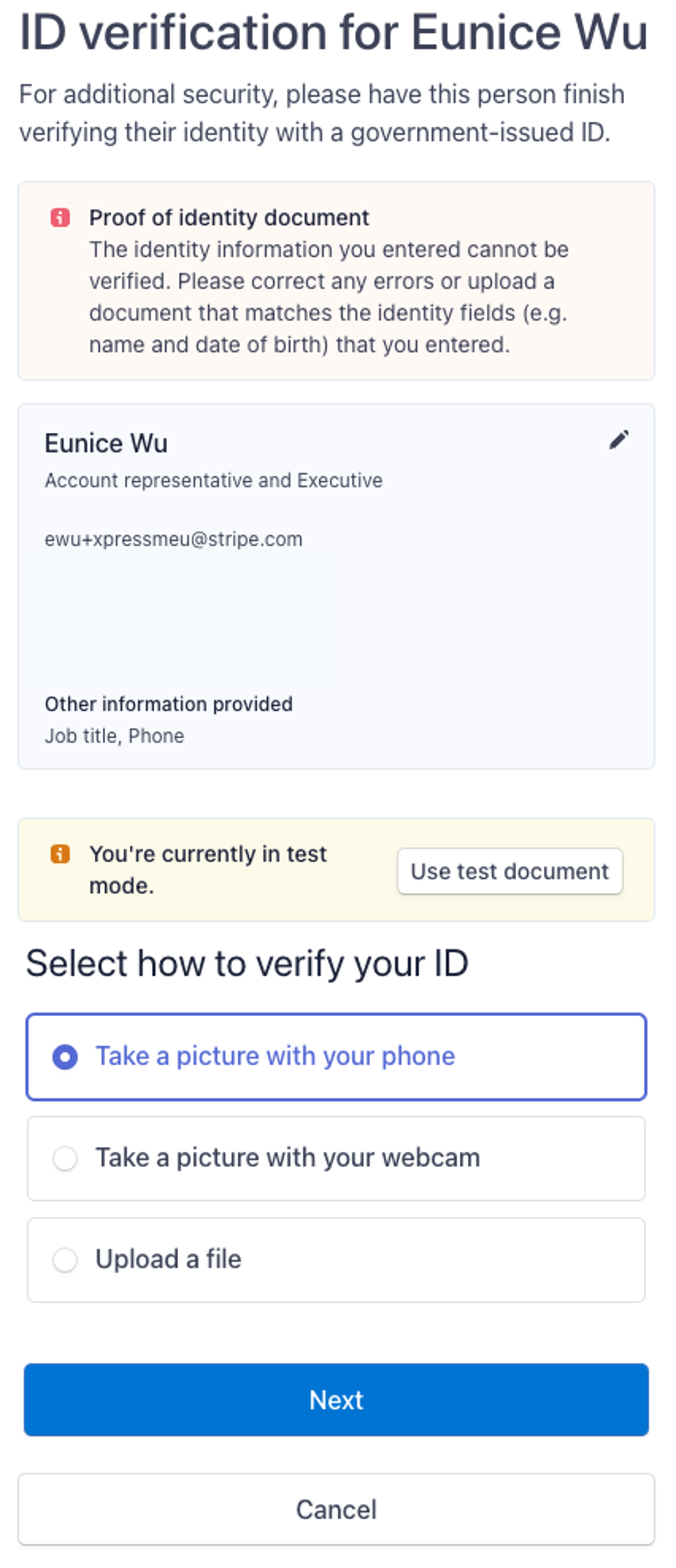

Delete6. KYC Check

You will need to upload a scan of one of the following ID documents for each person requiring a KYC check:

- Driver’s license

- Identity card

- Passport

The details on the ID of choice must match the details already entered for that person.

Once all KYC checks are done, you can click ‘Done’ and set up will be complete.

DeleteStep 3. Complete Verification

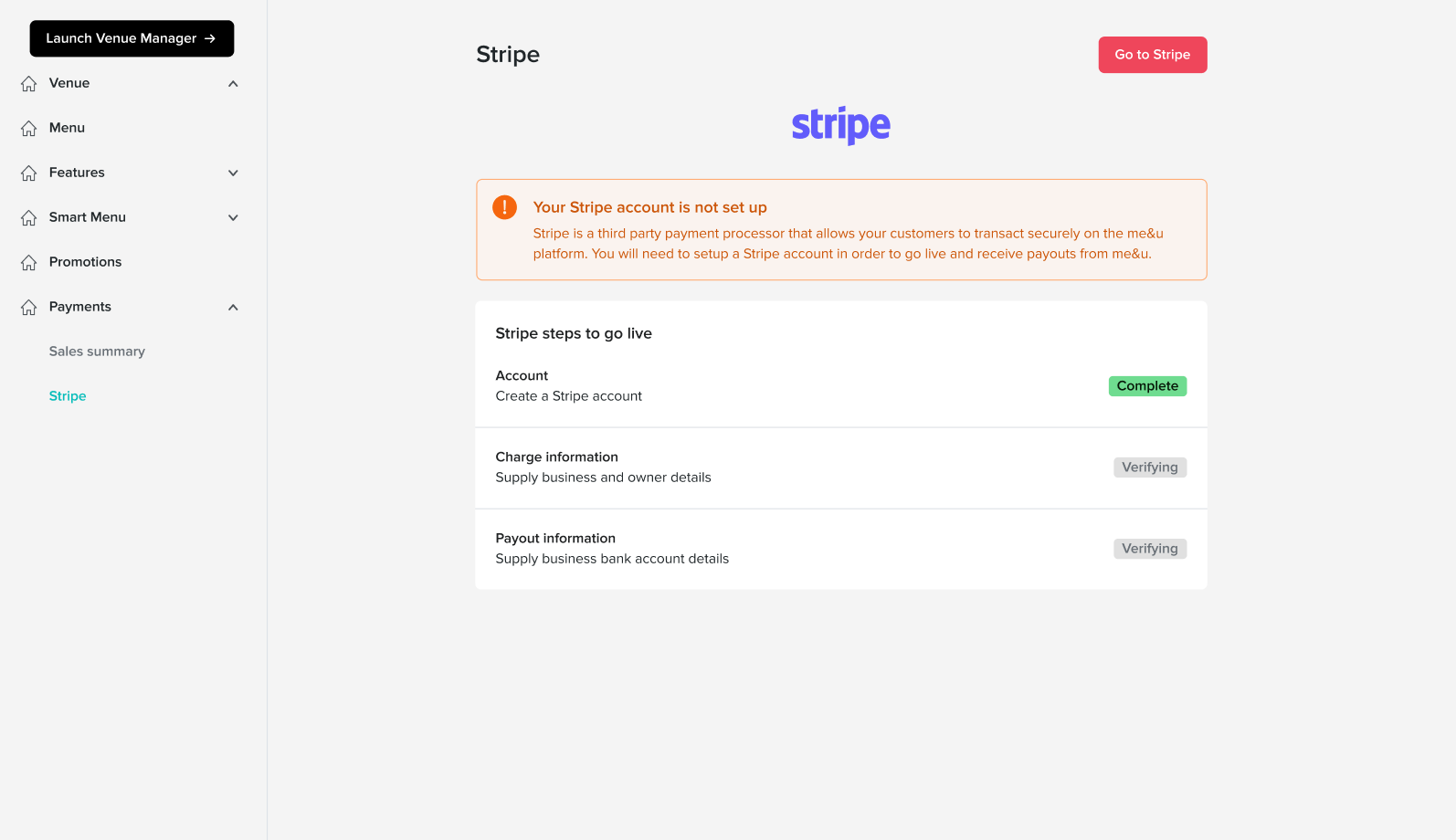

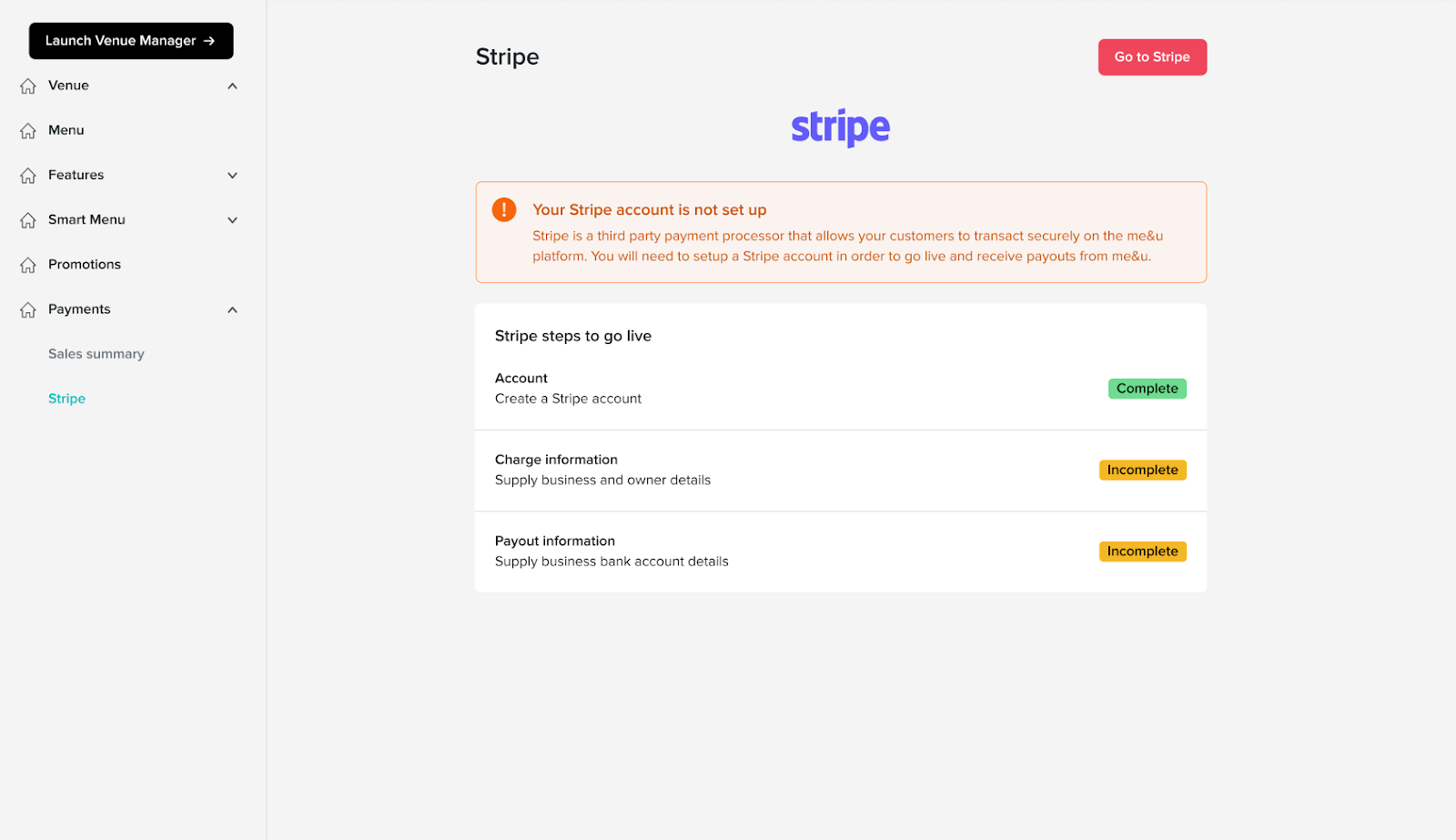

1. Redirect to Operator Portal

Upon successful completion of the onboarding process, you will be redirected back to the Operator Portal.

If Stripe cannot verify any of the information submitted the page will go back to the step before and show which sections are incomplete and need to be resubmitted.

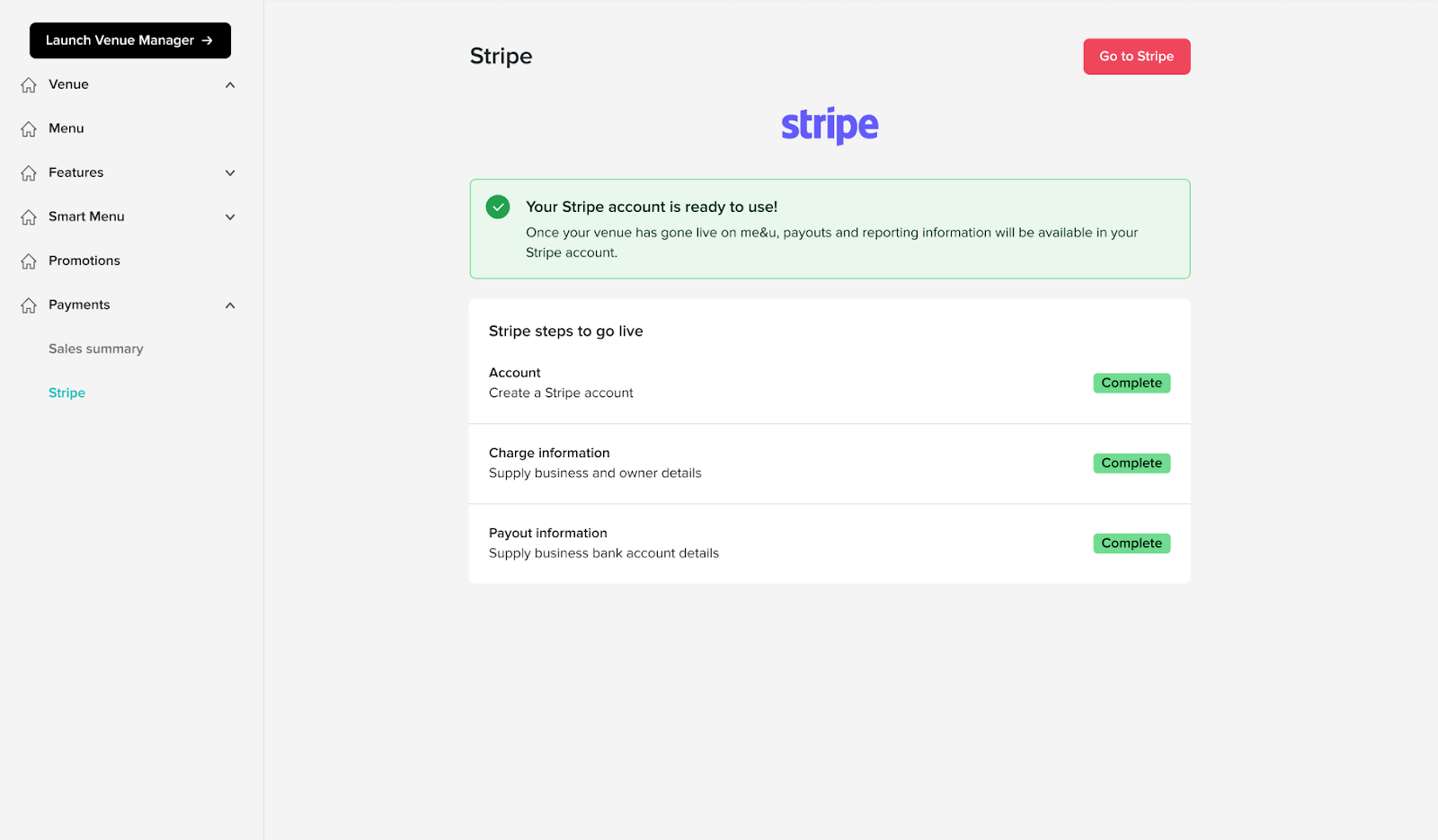

2. Verification Complete

When Stripe has successfully verified the supplied information then the account will be ready to transact using Stripe.

If you ever want to go to your Stripe account dashboard to view payment information or change any details you can do so clicking the ‘Go To Stripe’ button

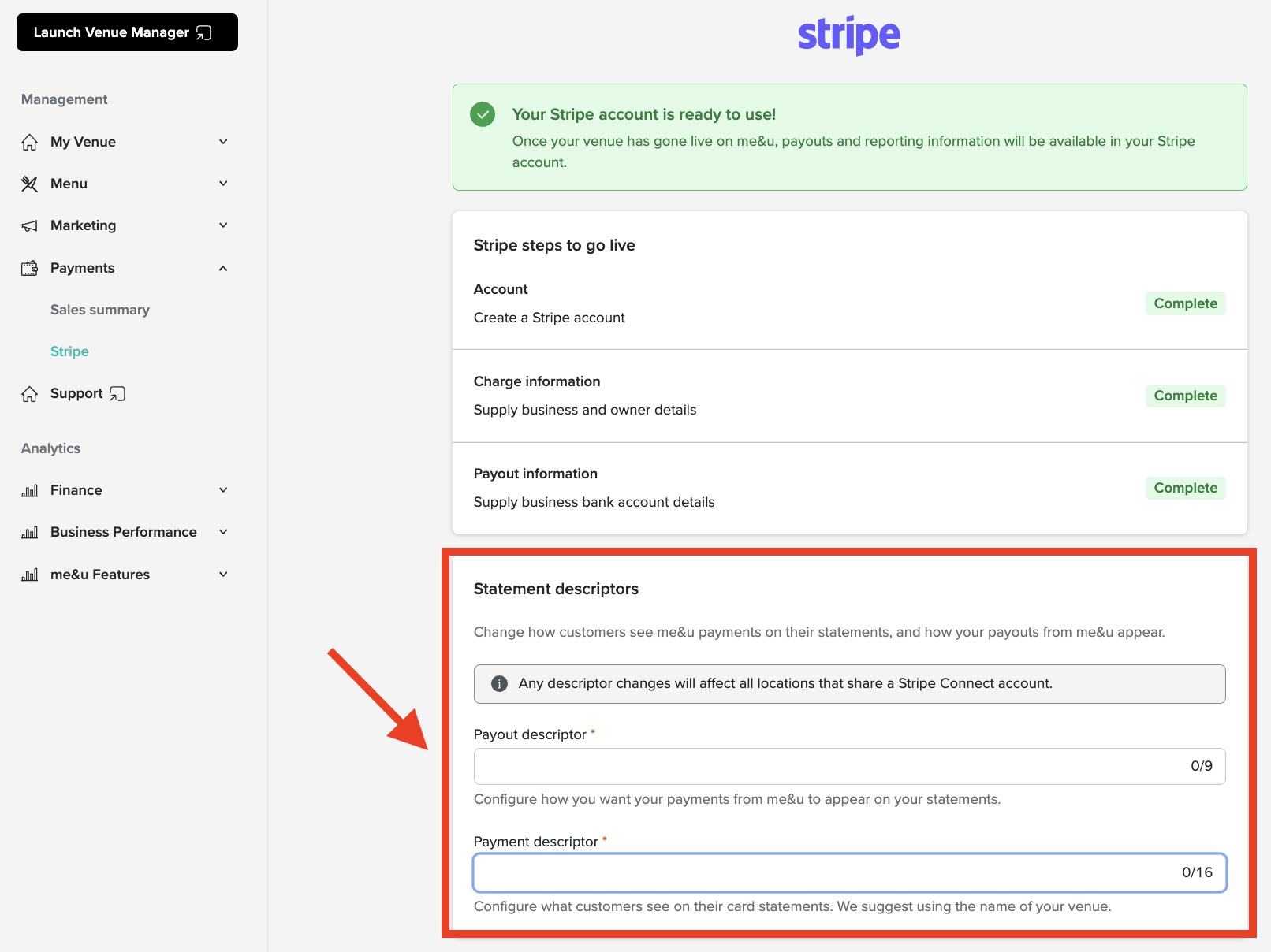

DeleteStep 4. Statement Descriptors

Editing Payout & Payment Descriptors

You can change how customers see me&u payments on their statements, and how your payouts from me&u appear.

To do this, fill in the details within the 'Statement descriptors' section.

If your venues are part of a group that share a Stripe connect account, it is not recommended to use the names of the venues as payment descriptors because any descriptor changes will affect all those locations. Instead, use the name of the group.

Step 5. Creating Multiple Stripe Accounts for Multiple Venues

If you have multiple venues transacting with me&u, you will need to ensure your accounts are set up correctly.

You will need a Stripe account for every unique combination of ABN and bank account your business requires.

Based on your account structure action the following:

Standard Group

Multiple me&u venues utilise the same ABN and the same Bank Account

- For one of your venues, complete the standard Stripe application as outlined in the above article

- After completion, send an email to your Account Manager or 'helpme@meandu.com.au' outlining:

- The name of the venue linked to your Stripe Account

- The names of all other venues utilising the same ABN and bank account

- The me&u team will then link all these accounts to your one Stripe Account and notify you once completed

Mixed Group - Same ABN

Multiple me&u venues utilise the same ABN but require unique Bank Accounts

- Using the same login details, complete the standard Stripe application as outlined in the above article for all venues utilising a unique combination of ABNs and bank accounts.

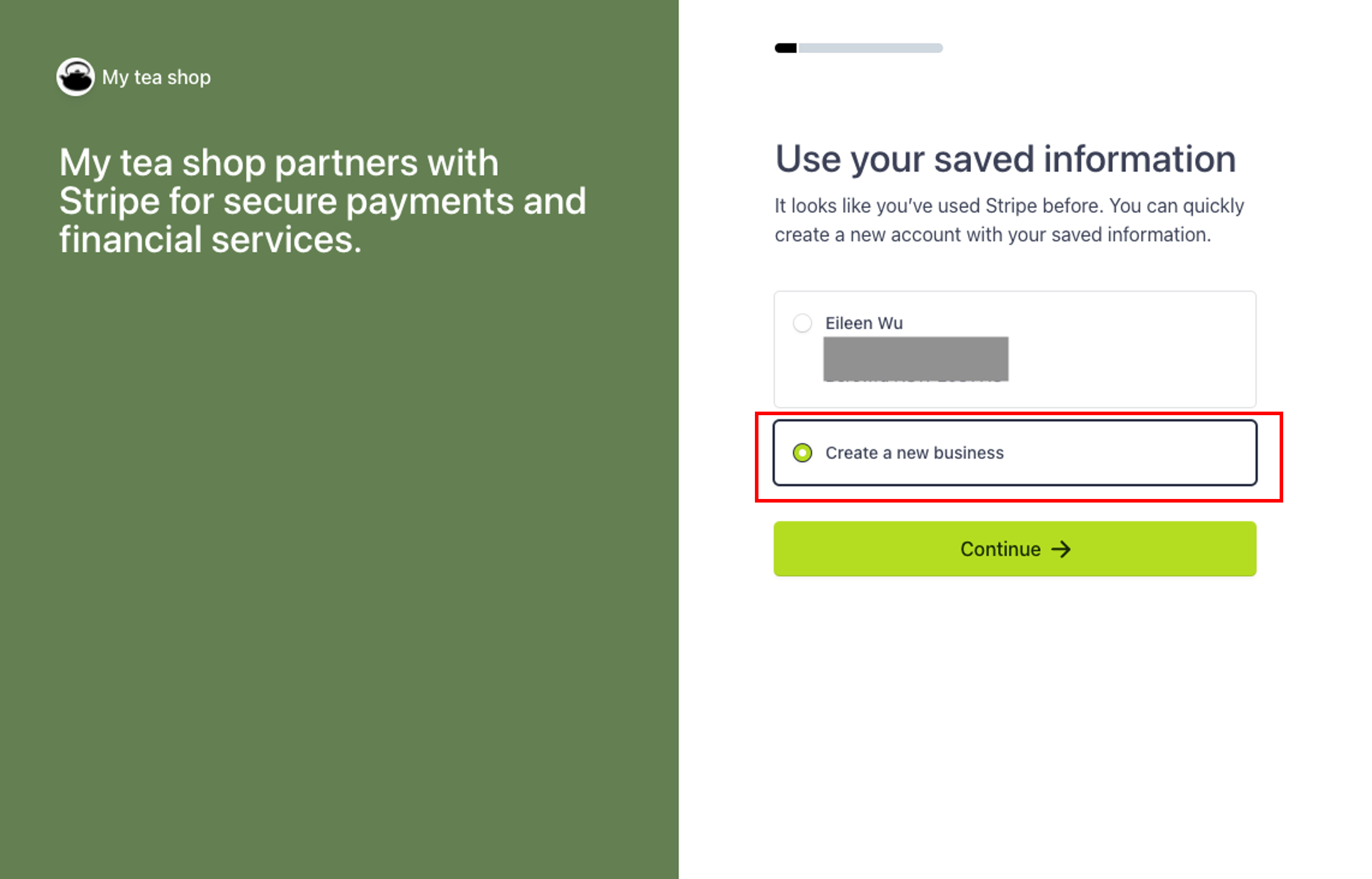

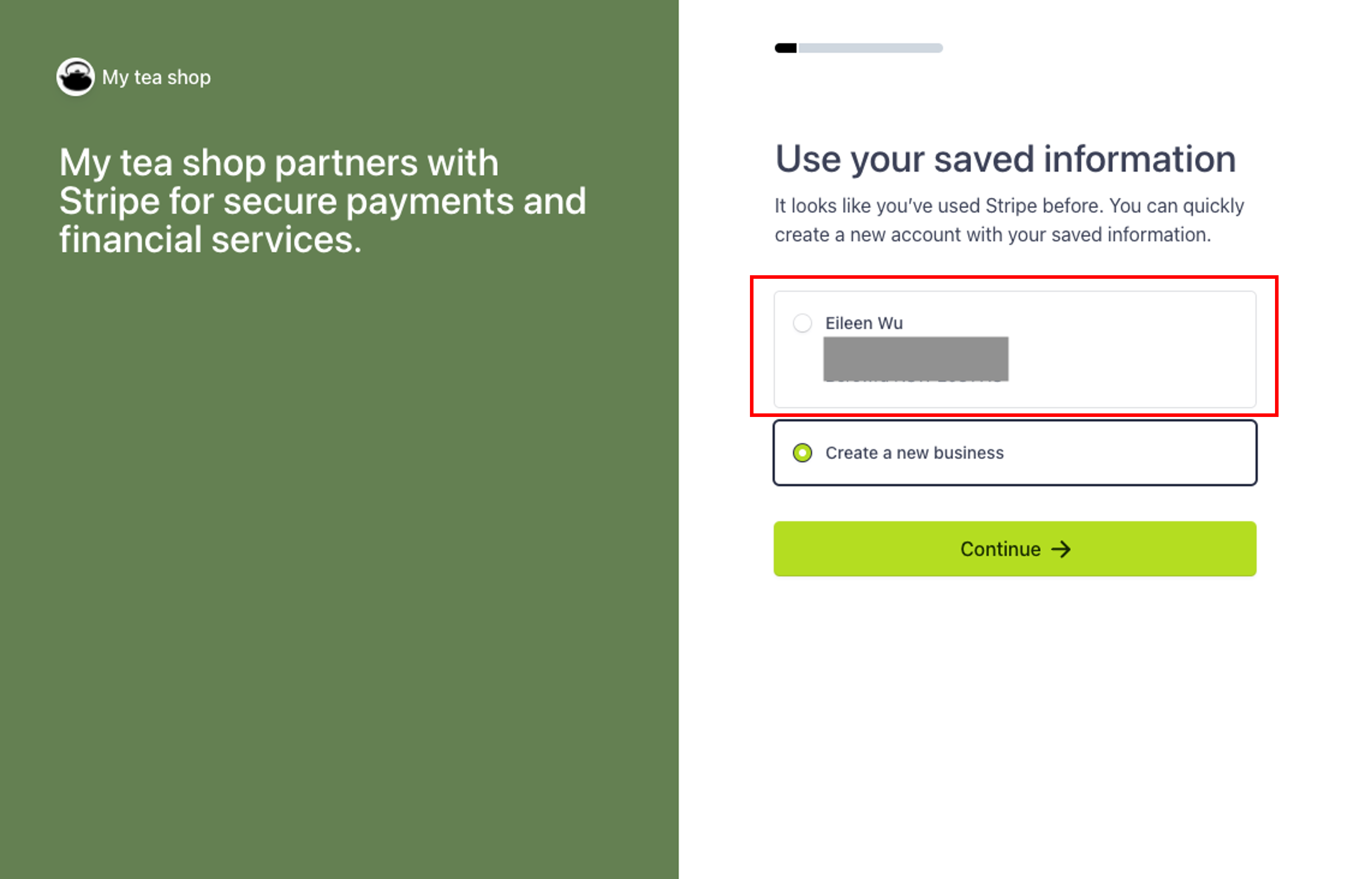

- For any venues that utilise the same ABN but varying bank accounts, once you have logged into Stripe you can select to use your saved information rather than re-entering your business details

Delete

Delete

Mixed Group - Unique ABN

Multiple venues utilise unique ABNs and unique bank accounts

- Using the same login details. Complete the standard Stripe application for all venues as outlined in the above article utilising a unique combination of ABNs and bank accounts.

- You will need to undergo a KYC check per ABN, therefore once you have logged into Stripe you should select to 'create a new business'