These FAQs contain the latest information about the Stripe migration as at 19th May. Please refer to this page if you have any questions as it will be updated from time to time.

Stripe Application Process

1. I haven't used the me&u operator portal before, how do I login and what is my password?

You should have received an email from 'Airtable with the subject ‘me&u Operator Portal Login Details'. This email will contain your temporary password. If you cannot locate this email, on the login page for the Operator Portal select 'Forgot my Password' to reset your account. Click here to watch an instructional video to help you find your login details.

2. What is KYC? Why are you asking for personal business details?

“Know Your Customer” (KYC) obligations for payments require Stripe to collect and maintain information on all Stripe account holders. These requirements come from our regulators and are intended to prevent abuse of the financial system.

In order to perform the check, Stripe needs to identify any individuals who ultimately own or control your business.

3. What documentation do I need to prepare prior to starting the Stripe application process?

- Business details including ABN/CRN, ACN, address, phone number, industry, website, bank account, etc.

- Either your personal details or that of the beneficial owners of your company, including name, home address, date of birth, job title, phone number

- % of ownership for any beneficial owner who owners more than 25% of your business

- Scans of identification documents - including Passport and/or Drivers Licence.

4. What is an ABN/ACN and where can I find it?

Australia

ABN stands for Australian Business Number. It is a unique 11 digit number that identifies your business to the government and community. You can search for an ABN on the Australian Business Register’s website.

ACN stands for Australian Company Number. It is a nine-digit number that only companies receive. The Australian Securities and Investments Commission (ASIC) issues ACNs. You can search for an ACN on the Australian Business Register’s website.

5. What is a CRN and where can I find it?

United Kingdom

CRN stands for Company Registration Number. It is unique to your limited company or LLP. You can find it on your certificate of incorporation and any official documentation received from Companies House. Your CRN is also displayed on the public register of companies, which can be accessed online via Companies House Service.

6. Who is a 'business representative' and why do they need to complete the Stripe application?

This person must someone who is authorized to sign for the company. To complete the KYC process, they will also need to have access to the personal information (name, date of birth, job title, home address, % of ownership of business) of the owners of your company.

7. What is a 'beneficial owner' and why do you need their information?

Information on all beneficial owners must be collected. Beneficial owners are persons who exercise significant management control over the company (executives) or who own 25% or more of the company (owners).

8. Where can I find instructions on how to complete the Stripe application process?

Click the relevant link below to view instructions on how to complete the Stripe application process:

9. I already have a Stripe account - how do I link the existing account to me&u for payments?

It may be possible to connect your existing Stripe account to me&u if your Stripe is an "express account".

Complete the Contact Details section on the Stripe portal with the same information on your existing account and if your account is an express account you will see your business and you can select to use your saved information rather than re-entering your business details.

If you do not see something similar to the below then this may suggest that your account is not an express account, and you will have to enter the business details and KYC as normal. .png)

10. If I already have a Stripe account with another service provider (e.g. Orderup), if I create an account under the me&u Platform Account is there a way I can see my existing accounts (Orderup and me&u Stripe) under one roof?

No, you cannot see your existing account on Orderup and see your me&u account under one account: Only one Platform can be connected to a Stripe account at any one time. See here. This ensures that in the rare case a user interacts with two platforms, each platform’s activity is kept distinct in separate accounts.

Next step is to create individual accounts under the same Stripe user login. Click here for instructions.

Customer Payment Options and Settlement

1. Will the timing of me&u settlements change with the switch to Stripe?

We estimate settlement days will remain the same.

2. If there is a public holiday, when will I receive my settlement from me&u?

You will receive payment 2 business days from the time the banks recommence processing. For example, the transaction happens on a Monday (which is a public holiday), banks re-opens on Tuesday, you will receive settlement on Wednesday.

3. What remitter name will appear on our bank statement when me&u settles funds?

You can change how customers see me&u payments on their statements, and how your payouts from me&u appear.

To do this, fill in the details within the 'Statement descriptors' section within Operator Portal.

If your venues are part of a group that share a Stripe connect account, it is not recommended to use the names of the venues as payment descriptors because any descriptor changes will affect all those locations. Instead, use the name of the group.

4. What will my remittance look like?

For now, no change is to be expected from your current remittance.

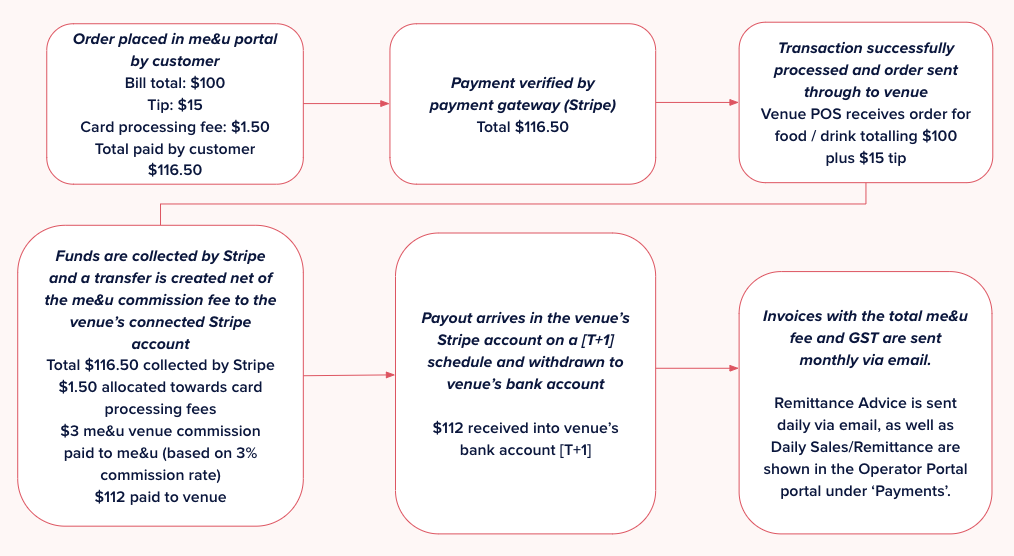

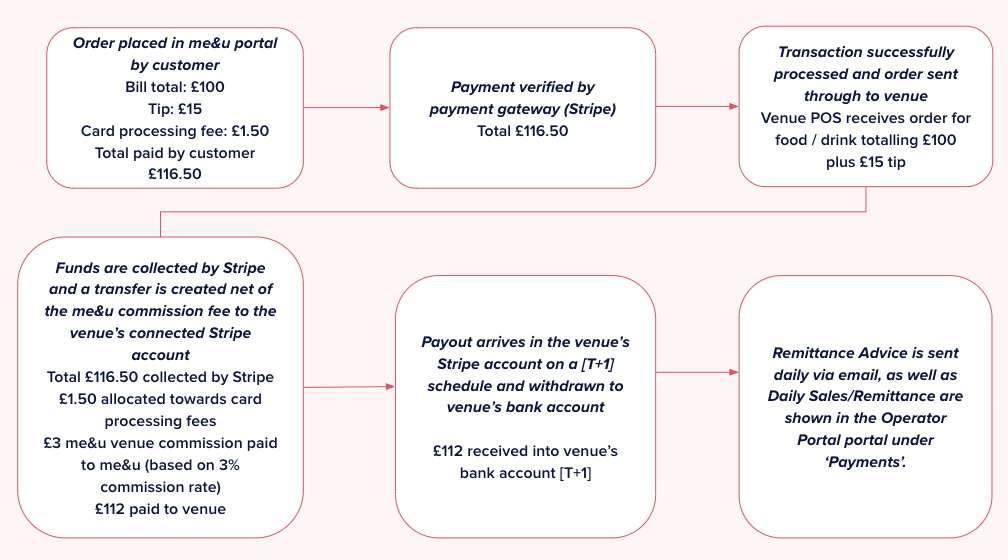

Invoices with the total me&u fee and GST are sent monthly via email. Remittance Advice is sent every week day via email and Daily Sales/Remittance are shown in the Operator Portal portal under ‘Payments’.

Click here to view reporting and reconciling.

7. What fees are paid by the venue to me&u and how much will the venue receive into their bank account and when?

AU & US

United Kingdom

Fraud and Security

1. What customer privacy measures does Stripe use?

Tokenisation: this means that me&u does not hold any confidential customer information. We have a secret code 'token' that we share with Stripe and Stripe uses it to do a lookup and charge the customer card on file. me&u does not hold any card details.

2. After me&u transitions over to Stripe, how will chargebacks work?

Currently, me&u will continue to handle and absorb outstanding chargebacks.

DeleteCosts

1. What are the customer card processing fees with Stripe?

Card processing fees are subject to review every month based on card providers. me&u uses the standard card processing fee and do not make any money off these fees.

DeleteSupport

1. I'm really struggling, who can I reach out to for help?!

Click the relevant link below to view instructions on how to complete the Stripe application process:

Alternatively, please reach out to our support team at helpme@meandu.com.au and let them know you need support completing your Stripe Application.

Delete